¡NUEVO MORDISCO!

Hablemos de la famosa conferencia Bretton Woods. No, no es nada siniestro.

The BRICS nations are making their move, but the story began in 1944 with a fatal flaw: the Triffin Dilemma.

We break down the seismic shifts in our global economy—and what they mean for the future.

Read the full analysis: https://open.substack.com/pub/nexusfinance/p/from-gold-backed-dollars-to-a-world?r=201p6r&utm_campaign=post&utm_medium=web

#Economics #Finance #DeDollarization #USDollar #BRICS #Gold #BrettonWoods

"So far, nothing that has been proposed mitigates the underlying tendency to build up imbalances within the system (large trade deficits and surpluses). However, this new institutional setting allows for two key interventions that will not only limit imbalances but will also unlock massive potential for mutual development. I call these two interventions The Levy and The Charge. Here is what they are and how they work.

- The Levy: A trade imbalance levy to be charged annually to each central bank’s kosmos account in proportion to its current account deficit or surplus and paid into a Common Development Fund (CDF) held at the kosmos issuing multilateral institution

- The Charge: Private financial institutions to pay a ‘surge’ fee into the same common fund, the CDF, in proportion to any surge of capital flows out of a country, reminiscent of the congestion price-hike that companies like Uber charge their customers at times of peak traffic.

The Levy’s rationale is to motivate governments of surplus countries to boost domestic spending and investment while systematically reducing the international spending power of deficit countries. Foreign exchange markets will factor this in, adjusting exchange rates faster in response to current account imbalances and cancelling out much of the capital flows which today support chronically unbalanced trade. As for the Charge, it will automatically penalise speculative herd-like capital inflows or outflows without, however, handing discretionary power to bureaucrats or the need for inflexible capital controls."

https://www.yanisvaroufakis.eu/2025/06/08/a-chinese-new-bretton-woods-quancha-op-ed/

Bitcoin: Rules-Based Money? - Cathie Wood on DOAC

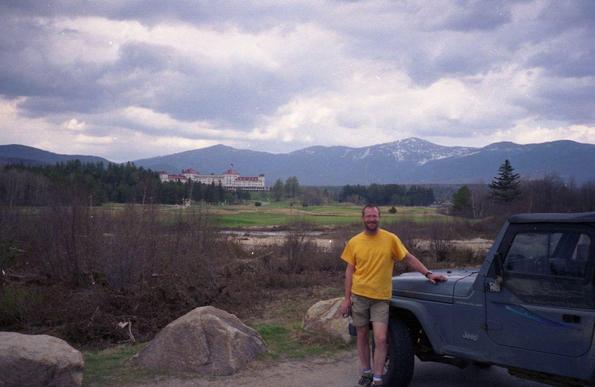

Passage à Bretton Woods, le lieu des "accords de Bretton Woods" (souvenez-vous de vos cours d'économie) : un grand hôtel en pleine montagne.

#whitemountains #brettonwoods #alabelleetoile

The Bretton Woods Agreement and the Reorganization of the Global Economic Order

The world economy is in crisis—can a new Bretton Woods save us? Learn about the Bretton Woods Agreement and the urgent need for a global economic reset in 2025! #BrettonWoods #GlobalEconomicReset #FinancialOrder

Gibt es eigentlich Alternativen zum US-Dollar und dessen Währungsregime?

Um etwas Licht in die Diskussion um das IWF-geprägte Währungssystem zu bringen, machen wir den Artikel von Christoph Scherrer aus PROKLA 213 frei zugänglich:

https://prokla.de/index.php/PROKLA/article/view/2081

#BrettonWoods #US-Dollar