Federal “debt” is the total of outstanding #Treasury #Securities.

The US government could pay off all its so-called “debt” tomorrow simply by debiting all Treasury-security accounts and crediting the Treasury-Security owners’ checking accounts.

The entire process neither adds nor subtracts money from the economy (but for interest paid).

#obligations #bonds #liquidity #borrowing #debt #money #Treasury #PublicTreasury #currency #MMT #policy #economy #credit #economics #macroEconomics #USPol

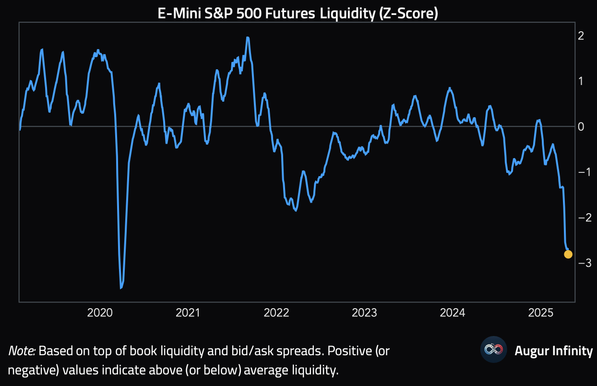

$SPX

Nobody ever reimburses national debt. Sovereign states restructure it.

#bonds #liquidity #liquidities #securities #borrowing #debt #deficit #money #Treasury #PublicTreasury #currency #MMT #policy #economy #credit #economics #obligations #titles #slogan #macroEconomics #rents #funding #politics

Is borrowing a burden on future generations?

No, it's not: if the borrower is a nation-state, then no person (children or taxpayers) will be asked to repay.

“Paying off the debt” is just the sovereign swapping Treasury securities (savings) for cash. No burden is passed on to persons.

#debt #Treasury #slogan #deficit #money #liquidity #liquidities #currency #MMT #transactions #economy #credit #economics #administration #government #sovereignty

---

## ТОП-10 операторів ринку обернених криптовалют

1. **BitGo (WBTC)**

- Основний кастодіан для Wrapped Bitcoin.

- Один із найнадійніших і найвикористовуваніших операторів обернення BTC у мережі Ethereum.

2. **Ren Protocol (renBTC, renZEC)**

- Протокол з відкритим кодом для безкастодіального обернення активів.

- Забезпечує міжмережеву ліквідність без централізованих посередників.

3. **Binance (BTCB, ETHB)**

- Пропонує власні обернені активи на Binance Smart Chain.

- Централізований, але з високою ліквідністю.

4. **Ankr (aETH, aMATIC)**

- Обернені токени для стейкінгу, які поєднують обернення з прибутковістю.

- Позиціонуються як рішення для стейкінгової ліквідності.

5. **pNetwork (pBTC, pLTC)**

- Кросчейн-протокол з підтримкою обернення різних активів на багатьох блокчейнах.

- Підтримує Ethereum, EOS, Binance Smart Chain тощо.

6. **Kava (Hard Protocol)**

- Пропонує обернені активи для кросчейн-кредитування в екосистемі Cosmos.

- Активно інтегрується в мультичейн-фінансові сервіси.

7. **Keep Network (tBTC)**

- Децентралізований протокол для обернення BTC у Ethereum.

- Основна увага на безпеці та прозорості.

8. **Thorchain**

- Кросчейн DEX із можливістю обернення та обміну активів без обгортки в ERC-20.

- Еволюційна альтернатива WBTC/renBTC.

9. **Wrapped.com**

- Інфраструктура для обернення активів на різні блокчейни, в партнерстві з BitGo.

- Підтримує WETH, WFIL, WZEC тощо.

10. **Allbridge**

- Кросчейн-мостовий протокол з можливістю обернення активів між EVM- і не-EVM-сумісними мережами (Solana, Terra, etc.).

---

## Хештеги

#WrappedCrypto #DeFi #WBTC #renBTC #Kava #BinanceSmartChain #CrossChain #Ankr #CryptoEducation #MetaMask #Ethereum #Bitcoin #CryptoForBeginners #DeFiExplained #CryptoSafety #WrappedAssets #Liquidity #Custody #CryptoRisks #ERC20 #TokenizedAssets #CryptoGuide

---

## Бібліографія та джерела:

- [WBTC Docs — wbtc.network](https://www.wbtc.network/)

- [Ren Protocol — ren.org](https://ren.org/)

- [Ankr Whitepaper — ankr.com](https://www.ankr.com)

- [pNetwork — p.network](https://p.network/)

- [Kava Platform — kava.io](https://www.kava.io/)

- [Keep tBTC — keep.network/tbtc](https://tbtc.network/)

- [Wrapped.com — wrapped.com](https://www.wrapped.com/)

- [Thorchain — thorchain.org](https://thorchain.org/)

- [Allbridge — allbridge.io](https://allbridge.io/)

- Binance Research: *“Tokenized BTC and the Liquidity of the Crypto Market”*, 2021

---

Хочеш — можу зробити інфографіку для Telegram/буклету чи зібрати англомовну версію.

#YonhapInfomax #EhwaEngineeringConstruction #CourtRehabilitation #Liquidity #KOSDAQ #OperatingLoss #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=59571

Mid-sized Construction Firm Ehwa Engineering & Construction Cancels Court Rehabilitation Application, Citing Secured Liquidity

Mid-sized construction firm Ehwa Engineering & Construction cancels court rehabilitation application after securing liquidity, plans to repay debts independently amid financial challenges and potential delisting concerns.

https://www.bloomberg.com/news/articles/2025-04-09/deutsche-bank-sees-fed-doing-emergency-qe-if-bond-rout-goes-on

#YonhapInfomax #USTreasuryYields #FederalReserve #MarketMalfunction #Liquidity #BondMarket #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=57998

Four Reasons for Surge in Ultra-Long US Interest Rates, Key is 'Market Malfunction' - Fed Intervention Possible

US Treasury yields surge abnormally, particularly in ultra-long term, due to potential market malfunction, prompting speculation of Fed intervention amid liquidity concerns and various market factors.