➤ 釋放數據潛力:LabPlot 讓科學探索更加直觀高效

✤ https://labplot.org/

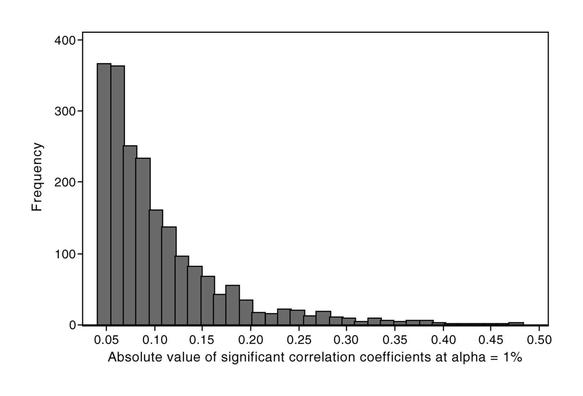

LabPlot 是一款免費、開源且跨平臺的科學繪圖與數據分析軟體,專為個人和專業人士設計,提供高品質的互動式繪圖、統計分析、迴歸擬合,以及支援 Python、R、Julia 等語言的互動式筆記本。該軟體還具備資料擷取、多格式資料匯入匯出與即時資料支援等功能,並已發布多個版本更新,且其使用者文件已遷移至 Sphinx/reStructuredText 框架,並獲得 NGI0 Core Fund 的資助。

+ 這款軟體聽起來功能非常強大,而且是開源的,很適合預算有限的學術研究。

+ 介面看起來很乾淨,支援多種程式語言很棒,期待它的表現。

#軟體開發 #數據分析 #科學繪圖 #開源專案

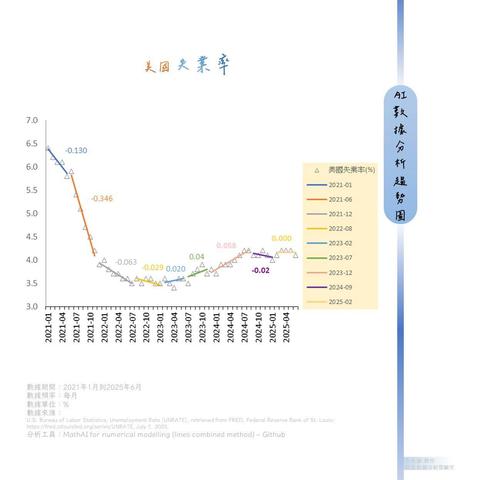

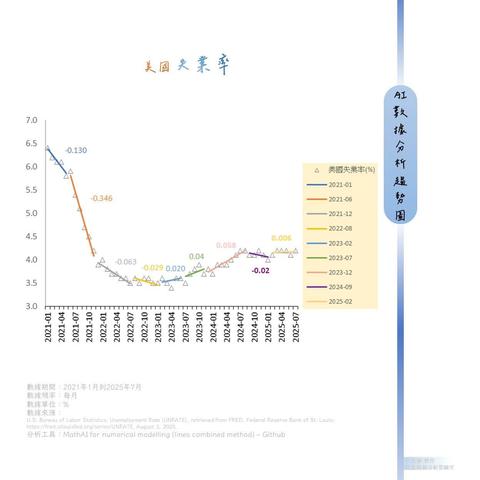

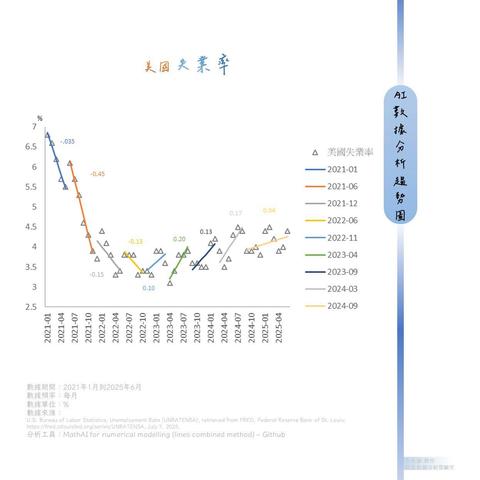

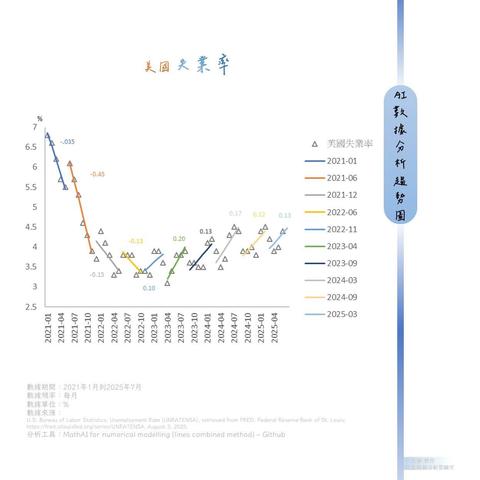

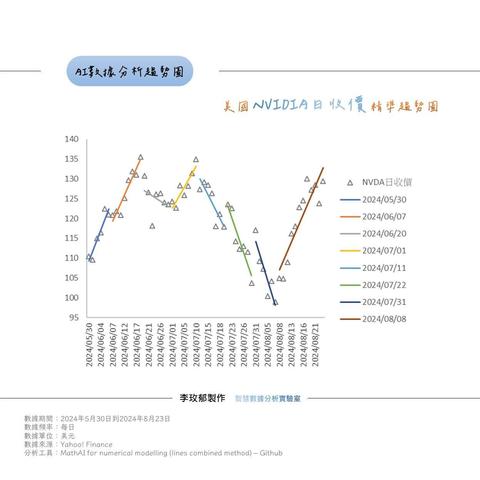

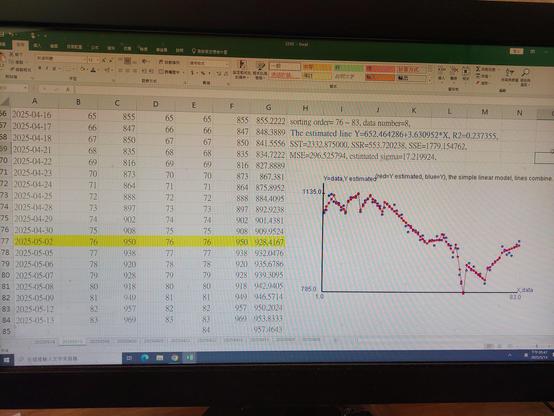

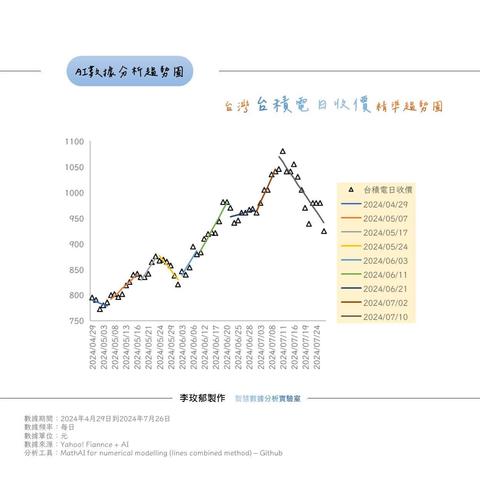

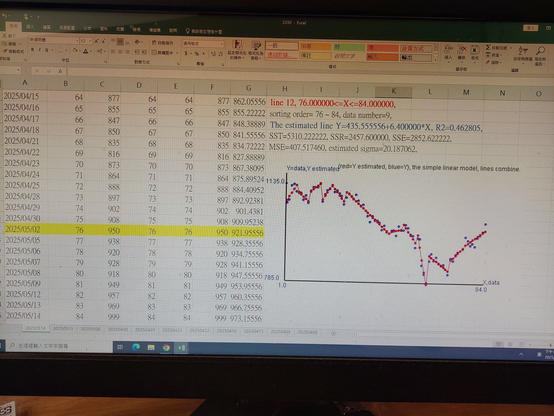

AI底層數據建模

AI底層數據建模