How Circular Deals Are Driving the AI Boom

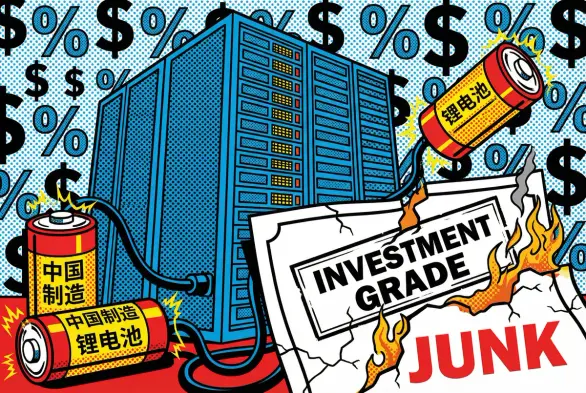

The AI industry is being powered by a complex web of "Circular Deals"—where tech giants invest in startups that then use that money to buy cloud credits from those same giants. We investigate whether this is a sustainable growth engine for the 2026 economy or a "shell game" that is artificially inflating the value of the AI sector.

#AIBoom #TechFinance #BusinessAnalysis #CloudComputing #SiliconValley #Economics #Investing

https://www.technology-news-channel.com/how-circular-deals-are-driving-the-ai-boom/