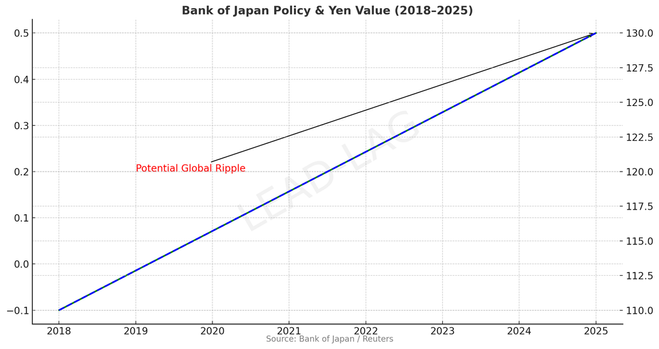

#Japan is the Saudi Arabia of Global Finance. Its zero interest rates are ending. This will impact #YenCarry trade, ADB financing and #US #Treasuries directly. If this unwinding is not done in a manageable and orderly manner, then the fallout will be worse than #TrumpTariffs or any mess that #DJT creates. #FederalReserve will raise interest rates when #Yen global financing will start to decline. Cherry on top, the #AIBubble.

https://substack.com/inbox/post/179099797

May we live in interesting times.