https://grafa.com/asset/astro-resources-nl-583-ase.asx?utm_source=asxmktsensitive&utm_medium=mastodon&utm_campaign=ase.asx

https://grafa.com/asset/astro-resources-nl-583-ase.asx?utm_source=asxmktsensitive&utm_medium=mastodon&utm_campaign=ase.asx

https://grafa.com/news/auto-and-cars-ftc-sues-uber-over-alleged-deceptive-practices-in-uber-one-subscription-service-424939?utm_source=us_news_en&utm_medium=mastodon&utm_campaign=424939

FTC sues Uber over alleged deceptive practices in Uber One subscription service

The United States Federal Trade Commission (FTC) filed a lawsuit against Uber Technologies (NYSE:UBER) on Monday, accusing the ride-sharing and delivery giant of engaging in deceptive practices concerning its Uber One subscription service. According to court documents, the FTC alleges that Uber enrolled consumers in the service and charged them without their consent, failed to provide the promised savings, and deliberately made it difficult for users to cancel their subscriptions. The lawsuit, filed in the U.S. District Court for the Northern District of California, claims Uber's actions violate the FTC Act and the Restore Online Shoppers' Confidence Act (ROSCA). The FTC highlights that despite Uber's "cancel anytime" assertions, consumers reportedly faced significant hurdles when attempting to end their subscriptions, in some cases requiring navigation through numerous screens and steps. The commission asserts that these practices are misleading and harmful to consumers. The filing of this lawsuit marks a significant legal challenge for Uber regarding its subscription model and its adherence to consumer protection laws.

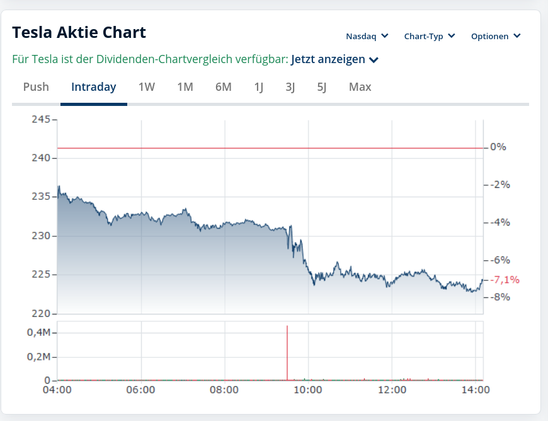

https://qz.com/tesla-q1-earnings-stock-elon-musk-doge-trump-1851776989

Tesla's biggest bull says Elon Musk faces a 'Code Red Situation' — and needs to leave DOGE

#X #twitter #elonmusk #nazi #elon #fascist #musk #kakistocracy #us #coup #usa #junta #wallstreet #robot #optimus #tech #technology #markets #stocks #equities #valuation #investors #traders #trades #dow #nasdaq #nyse #sp500 #TSLA #tesla #swasticar #earningscall #earnings #doge #usaid #economy #finance #uspol

https://grafa.com/news/financial-shares-of-us-lenders-drop-as-trump-reignites-criticism-of-fed-chair-powell-424934?utm_source=us_news_en&utm_medium=mastodon&utm_campaign=424934

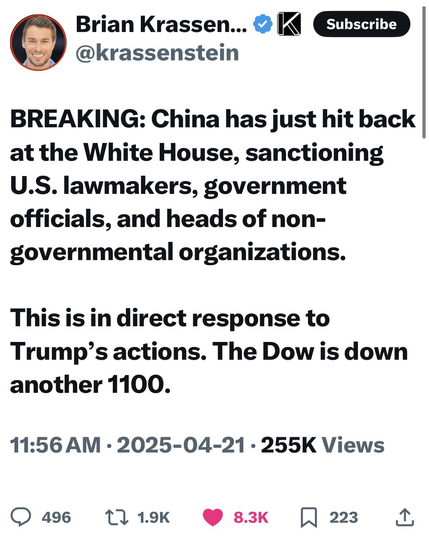

Shares of US lenders drop as Trump reignites criticism of Fed Chair Powell

<p data-pm-slice="0 0 []">Shares of major U.S. banks experienced a downturn on Monday following President Donald Trump's recent criticism of Federal Reserve Chair Jerome Powell. <p data-pm-slice="0 0 []">The President's comments have reignited concerns among investors regarding the independence of the central bank in determining monetary policy. Leading financial institutions saw notable declines in their stock values. JPMorgan Chase (NYSE:JPM), Goldman Sachs (NYSE:GS), Bank of America (NYSE:BAC), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC) shares fell between 1% and 2.7%. Morgan Stanley (NYSE:MS) led the declines among the major banks. The President's remarks are contributing to broader market uncertainty, adding pressure not just on the financial sector but on the overall market sentiment. This development adds another layer of complexity to the outlook for the Federal Reserve's interest rate decisions throughout the year. Investors are particularly sensitive to signals about monetary policy direction, especially against a backdrop of concerns that the U.S. economy may be slowing down, partly due to ongoing trade tariffs. The S&P 500 Banks index reflects the sector's recent struggles, showing a decline of 11.1% year-to-date.

https://grafa.com/news/manufacturing-ennis-reports-lower-revenue-and-earnings-for-q4-and-fiscal-year-2025-424928?utm_source=us_news_en&utm_medium=mastodon&utm_campaign=424928

Ennis reports lower revenue and earnings for Q4 and fiscal year 2025

<p data-sourcepos="1:1-1:203">Ennis (NYSE:EBF) today reported its financial results for the fourth quarter and fiscal year ended February 28, 2025, showing a decrease in revenues for both periods compared to the previous year. <p data-sourcepos="3:1-3:667">For the fourth quarter, Ennis reported revenues of $92.7 million, a 4.8% decrease from the $97.4 million reported for the same quarter last year. <p data-sourcepos="3:1-3:667">Amidst the revenue decline, gross profits saw a slight decrease, totalling $27.4 million, or 29.5% of revenues, compared to $27.7 million, or 28.4%, in the prior year's fourth quarter. <p data-sourcepos="3:1-3:667">The company also noted a sequential improvement in gross profit margin, rising from 29.3% in the third quarter ended November 30, 2024, to 29.5%. <p data-sourcepos="3:1-3:667">Net earnings for the quarter came in at $9 million, or $0.35 per diluted share, down from $10.1 million, or $0.39 per diluted share, in the comparable prior-year quarter. <p data-sourcepos="5:1-5:461">Looking at the full fiscal year ended February 28, 2025, Ennis's revenues came in at $394.6 million, a 6.1% decrease from $420.1 million in the previous fiscal year. <p data-sourcepos="5:1-5:461">Gross profits for the fiscal year totalled $117.3 million, or 29.7%, slightly down from $125.3 million, or 29.8%, in the prior fiscal year. <p data-sourcepos="5:1-5:461">Meanwhile, net earnings for the fiscal year were reported at $40.2 million, or $1.54 per diluted share, compared to $42.6 million, or $1.64 per diluted share, for the prior fiscal year.

https://grafa.com/news/health-concentra-to-acquire-pivot-onsite-innovations-in--55m-deal-424927?utm_source=us_news_en&utm_medium=mastodon&utm_campaign=424927

Concentra to acquire Pivot Onsite Innovations in $55M deal

<p data-pm-slice="0 0 []">Concentra Group Holdings Parent (NYSE:CON), the nation’s largest provider of occupational health services, today announced the signing of a definitive agreement to acquire Pivot Onsite Innovations from Athletico Physical Therapy. <p data-pm-slice="0 0 []">The transaction, valued at $55 million, subject to adjustment, is expected to significantly expand Concentra's presence in the onsite health sector. Pivot Onsite Innovations is a leading provider of onsite health services, operating over 200 clinics located directly at employer worksites across more than 40 states. For over two decades, Pivot Onsite Innovations has delivered a range of services, including occupational health, wellness, prevention, and performance programs aimed at improving employee health outcomes. This acquisition will notably enhance Concentra's Onsite Health segment, adding Pivot's extensive network and expertise to Concentra's existing operations. Meanwhile, key members of the Pivot Onsite Innovations executive team, including Dr. Goren, Scott Goren, and Paul Goren, will transition to Concentra Onsite Health upon the closing of the transaction, ensuring continuity in leadership and expertise. Both companies have expressed a strong commitment to a seamless transition for Pivot's existing clients. They emphasized that there will be no disruption to current services and that Pivot's customers will continue to receive care from their established and trusted teams, now supported by Concentra's expanded resources and capabilities. Concentra anticipates financing the $55 million transaction through a combination of cash on hand and available borrowing capacity under its existing revolving credit facility. The acquisition is subject to customary closing conditions and is currently expected to close in the second quarter of 2025.

https://grafa.com/news/health-gilead-s-trodelvy-keytruda-combo-shows-promise-in-slowing-aggressive-breast-cancer-424921?utm_source=us_news_en&utm_medium=mastodon&utm_campaign=424921

Gilead's Trodelvy-Keytruda combo shows promise in slowing aggressive breast cancer

Gilead Sciences (NASDAQ:GILD) announced Monday that a Phase 3 trial demonstrated its drug Trodelvy, when combined with Merck’s (NYSE:MRK) Keytruda, significantly delayed disease progression in patients with advanced triple-negative breast cancer expressing PD-L1. The study, involving 443 previously untreated patients, compared the Trodelvy-Keytruda combination to standard chemotherapy plus Keytruda. Triple-negative breast cancer, which accounts for 10-15% of breast cancer cases, is notoriously resistant to hormone therapies and targeted treatments. Trodelvy, an antibody-drug conjugate, delivers anti-cancer drugs directly to malignant cells, potentially reducing harm to healthy tissue compared to traditional chemotherapy. Gilead’s chief medical officer, Dietmar Berger, highlighted that the combination therapy showed a “statistically significant and clinically meaningful” improvement in progression-free survival, typically extending from five to seven months with current treatments. Early data also suggests a trend toward improved overall survival, though further follow-up is needed. Meanwhile, the safety profile of the Trodelvy-Keytruda combo aligned with the known effects of each drug, with Trodelvy carrying warnings for neutropenia and severe diarrhea. Already approved for certain advanced breast cancer cases, Trodelvy is being tested in additional trials, including for triple-negative breast cancer patients without PD-L1 expression. Gilead plans to share detailed results at a future medical meeting and discuss the findings with regulatory authorities, potentially positioning the combination as a new standard of care.