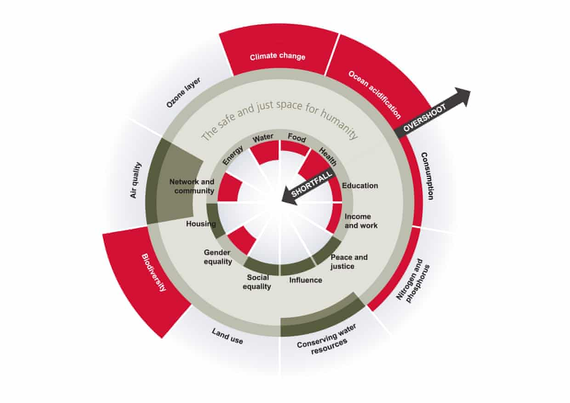

Fwiw, i entirely agree, & regard this gabfest with abject disdain, but not only for similar reasons to BK. IMO the entire wet dream of "productivity" in the current AusPol sense is fraudulent & wrong, predicated as it is on a bullshit economic model which continues to ignore fundamental restructure like #UBI, #MMT, #DoughnutEconomics et al. 😡🖕 🤢🤮

QUOTE BEGINS

While the productivity roundtable may not lead to significant economic reforms, it will effectively serve as a demonstration of the way Australian politics has become a contest of competing vested interests rather than visions of the national interest.

Since Labor announced the roundtable as a post-election sop to answer the incessant clamour to do something about productivity, big business lobby groups, individual business sectors — especially the tech sector, armed with its AI-fueled delusions of grandeur — and trade unions have jointly engaged in a huge exercise in gaslighting Australians. The goal: convince us that “reforms” that just so happen to serve their own interests, or those of the people they represent, or to fit their own ideology, are crucial to fixing productivity.

Whether it was unions demanding a four-day week, higher government spending and bans on job losses; big business asking for the usual (company tax cuts, IR deregulation, higher GST) or individual industries like tech demanding handouts, at no stage has any sector actually proposed something that didn’t suit their own agenda. It’s a staggering and incessantly repeated coincidence — what’s good for each of the participants happens, they assert, to be exactly what the economy needs.

And there were certainly no participants in the process who advocated for something problematic for them, but which they recognised would be the national interest. The closest we got was the Commonwealth Bank (CBA) telling the Productivity Commission that a company tax cut would be nice but wasn’t that big a deal while dividend imputation remained in place — though that didn’t stop the CBA from objecting to the PC’s tax plan on the basis it would hurt big companies.

It’s quite a contrast with the Accord era from the early 1980s to mid 1990s, when trade unions — with far more extensive coverage of the workforce than currently applies — signed up with the Hawke-Keating government to a plan to reduce real wages to curb the real wage overhang (when wages grow faster than productivity) and prevent yet another outbreak of wage-fueled inflation.

Indeed whole areas of productivity are apparently verboten this week, such as the level of concentration in the economy, which the Productivity Commission, Treasury and the Reserve Bank have all identified as undermining productivity and increasing mark-ups for large firms. It’s certainly not in the interests of big business to have anything done about the high levels of concentration they exploit to lift prices and reduce innovation and investment.

But even the PC — the most evidence-based and most independent participant in the whole process — downplayed the importance of competition, despite the modelling it commissioned for its tax proposal revealing that since 2018, the proportion of the company tax base in the form of economic rents increased from 41% to 54%. Today’s speech by Commission chair Danielle Wood focuses instead on the level of regulation in the economy and changing the tax mix.

Surrounded by vested interests attempting to influence policy, the government notionally has to pursue the national interest. After all, Albanese-era Labor has made a point of trying to show voters that the political-economic system can work for them, not just for vested interests.

But the government is merely another vested interest in the process itself. Its studied refusal to contemplate the simple, highly effective reform of a single national carbon price — as recommended by the PC — while it persists with profoundly flawed, costly policies like its Safeguard Mechanism, is a case in point. So too is its expensive, manufacturing-union-friendly Future Made In Australia spending, partly designed to expand industries in which Australia has no competitive advantage, merely an advantage in businesses with their hands stuck out.

And vested interests can take a variety of forms. The PC recently recommended that a host of “nuisance tariffs“, which raise less revenue than the economic harm they cause, be abolished. Treasurer Jim Chalmers, to his credit, has now suggested he’s keen to do that, having already dumped a bunch of such imposts during Labor’s first term. But, he told the Financial Review’s Phillip Coorey, he was going to hold off on doing so for some of them because of “Trade Minister Don Farrell, who is trying to negotiate a free trade deal with the European Union and might need to use some of the nuisance tariffs to barter”.

Think that through — we’re currently running a bad policy that inflicts net costs on us, but we’ll hold off on fixing it so that we can offer it to help get over the line a preferential trade deal, which, like all preferential trade deals, will give us few advantages (especially when the additional complexity of new Country of Origin rules is imposed).

Talk about self-defeating. But, hey, a trade deal with the EU would be a political win for the government, and that’s the important thing.

This week’s roundtable is a gathering of hypocrites, shysters and con artists, ostensibly divided and even at loggerheads in their views, but united in self-interest. As for ordinary Australians, none of whom have a seat at the table, their interests will mainly serve as window dressing for vested interests.

QUOTE ENDS