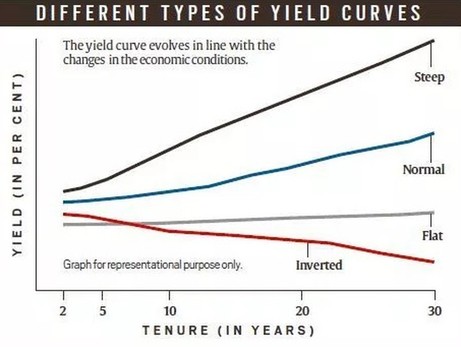

While long term rates could be seen as an average of short term rates (pure #expectations), investors need a #premium to hold long term debt instruments (inspired by market #segmentation). This premium is a reward for holding less liquid long term instruments and is therefore called the liquidity premium. This implies that even if the yield curve is flat(tish), it will develop an upward slope once #liquidity premium is Included.

#termstructure #liquiditypremium

More at https://slicesofperception.tumblr.com/post/188287724672/liquidity-premium-theory?is_related_post=1