Looking for tax-efficient returns without equity risk?

Here are 5 MF categories smart investors are using in 2025:

📊 Arbitrage, Multi-Asset, Gold/Silver ETFs & more

🧾 Up to 12.5% LTCG rate

🚫 No direct equity exposure

Source: ET Graphics

Looking for tax-efficient returns without equity risk?

Here are 5 MF categories smart investors are using in 2025:

📊 Arbitrage, Multi-Asset, Gold/Silver ETFs & more

🧾 Up to 12.5% LTCG rate

🚫 No direct equity exposure

Source: ET Graphics

Table of Contents1. FAQ Summary 2. RIF Basics 3. Severance Pay 4. Health Insurance (FEHB) 5. Life Insurance (FEGLI) 6. Retirement Benefits 7. Priority Hiring Programs 8. Leave Balances 9. TSP Account Options 10. Tax Consequences 11. Support Resources 12. Unemployment Benefits 13. Action Plan Timeline 14. Table of Key RIF Elements 15. Next StepsSummaryThis FAQ addresses the financial implications of a federal Reduction in Force (RIF), covering: • Severance pay calculation and eligibility • Health

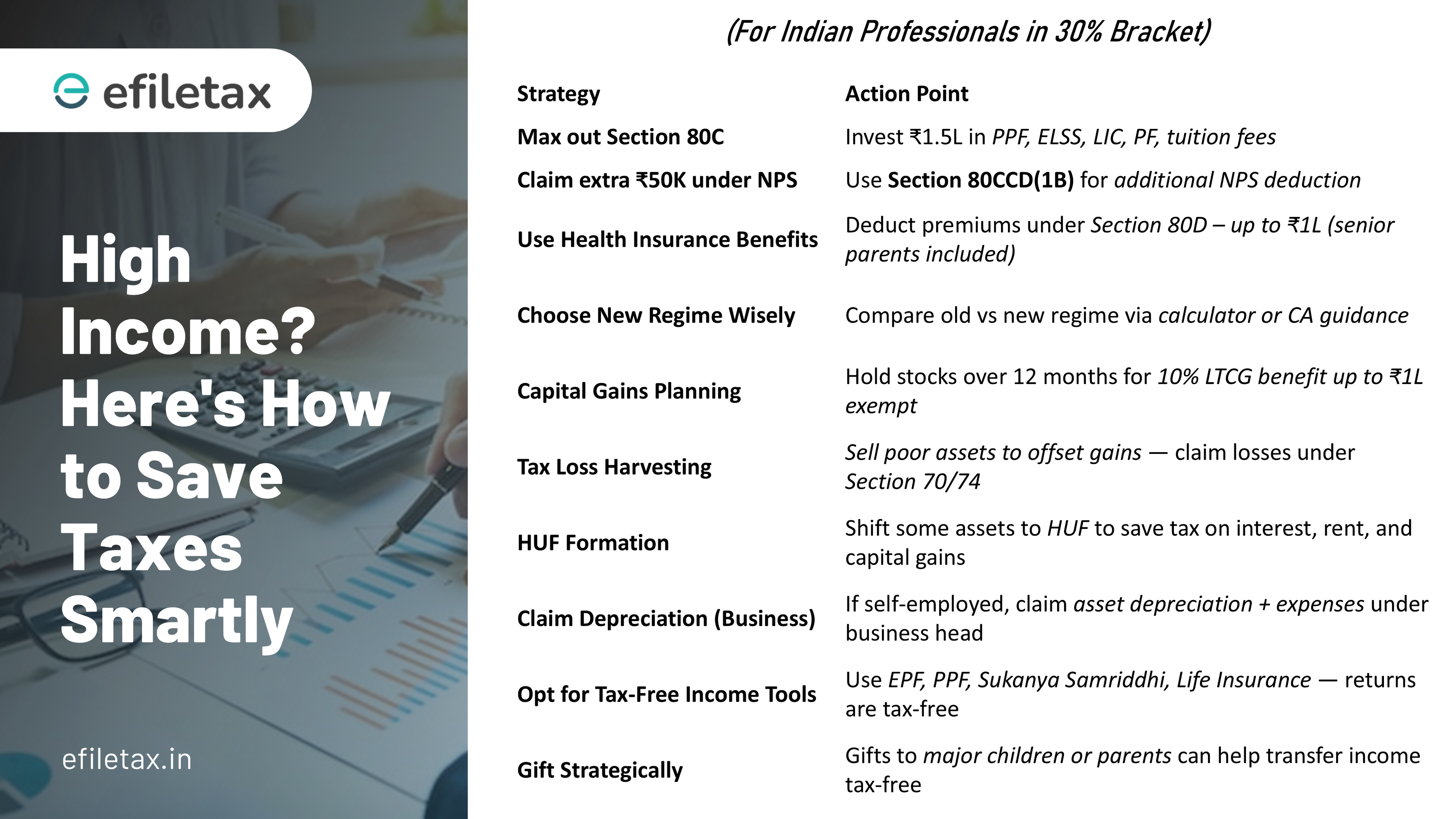

High income = high tax? Not anymore.

Here are 10 sharp, legal strategies Indian professionals in the 30% bracket can use to save lakhs.

👇Table simplifies what works 👇

Table of Contents1. FAQ Summary 2. RIF Basics 3. Severance Pay 4. Health Insurance (FEHB) 5. Life Insurance (FEGLI) 6. Retirement Benefits 7. Priority Hiring Programs 8. Leave Balances 9. TSP Account Options 10. Tax Consequences 11. Support Resources 12. Unemployment Benefits 13. Action Plan Timeline 14. Table of Key RIF Elements 15. Next StepsSummaryThis FAQ addresses the financial implications of a federal Reduction in Force (RIF), covering: • Severance pay calculation and eligibility • Health

🚫 Gifting to your spouse doesn’t reduce your tax liability.

Under Section 64(1)(iv), any income earned from assets transferred to a spouse without consideration is clubbed back to you.

✅ Rental income

✅ Interest

✅ Capital gains

✅ Dividends

Even if they invest it smartly, it’s still your taxable income.

Old vs New Tax Regime: Which saves you more on ₹36L income?

Check this comparison for FY 2024-25!

No surcharge applies as taxable income is below ₹50L.

Which regime are you choosing? ⬇️

The transition to the current Military Blended Retirement System (BRS) was one of the most significant changes to military retirement in decades. It modernizes the legacy pension system, also known as the High-3 system, while introducing new elements designed to benefit service members of all career lengths. Understanding how BRS works is crucial for making informed financial decisions that maximize your retirement benefits.Table of Contents: • Introduction: What is the Military Blended Retireme

Table of Contents1. FAQ Summary 2. RIF Basics 3. Severance Pay 4. Health Insurance (FEHB) 5. Life Insurance (FEGLI) 6. Retirement Benefits 7. Priority Hiring Programs 8. Leave Balances 9. TSP Account Options 10. Tax Consequences 11. Support Resources 12. Unemployment Benefits 13. Action Plan Timeline 14. Table of Key RIF Elements 15. Next StepsSummaryThis FAQ addresses the financial implications of a federal Reduction in Force (RIF), covering: • Severance pay calculation and eligibility • Health

Last-minute tax planning? 💸📊

Don't wait till it's too late! Strategize now for a smoother tax season ahead.

👉 Apply Deductions Early

👉 Time your Income Smartly

👉 IRS Audit Assistance

👉 Maximise RRSP Contributions

#TaxTips #YearEndPrep #TaxPlanning #FinancialFreedom #SmartFinance #TaxSeason #YearEndPlanning #TaxSavvy #TaxStrategy #FinancialFreedom #PlanAhead #TaxSeasonReady

Should You Hold Buy-to-Let Properties Personally or via a Company? 🏡💼

✅ Personal Ownership: Simpler setup, no extra admin, but higher tax on rental income & capital gains.

✅ Company Ownership: Lower tax rates, mortgage options, better estate planning, but higher costs & admin.

✅ Best Choice? Depends on your tax position & long-term goals!

#BuyToLet #PropertyInvestment #TaxPlanning #WealthManagement

📖 Free UK Property Tax eBook: https://zurl.co/oZhci