State Street reports global institutional investors continue to favor risk assets, keeping bond allocations low, with North American equities leading and renewed carry trade activity in FX and emerging market bonds.

#YonhapInfomax #StateStreet #RiskAppetite #InstitutionalInvestors #USEquities #CarryTrade #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85205State Street - Global Risk Appetite Remains Strong—Investors Hesitant to Return to Long-Term Bonds

State Street reports global institutional investors continue to favor risk assets, keeping bond allocations low, with North American equities leading and renewed carry trade activity in FX and emerging market bonds.

Goldman Sachs has upgraded its global equities outlook to overweight, citing strong earnings growth, Fed easing, and supportive fiscal policies, while warning of potential risks from shifts in investor sentiment and macroeconomic shocks.

#YonhapInfomax #GoldmanSachs #GlobalEquities #EarningsGrowth #FederalReserve #RiskAppetite #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=83992

Goldman Sachs Upgrades Global Equities to Overweight on Strong Earnings Outlook

Goldman Sachs has upgraded its global equities outlook to overweight, citing strong earnings growth, Fed easing, and supportive fiscal policies, while warning of potential risks from shifts in investor sentiment and macroeconomic shocks.

Moody's Downgrades Korea Investment & Securities to 'Baa3'—Cites High-Risk Business Model

Moody's downgraded Korea Investment & Securities to 'Baa3', citing increased risk appetite and a weakened funding structure, while revising the outlook to stable.

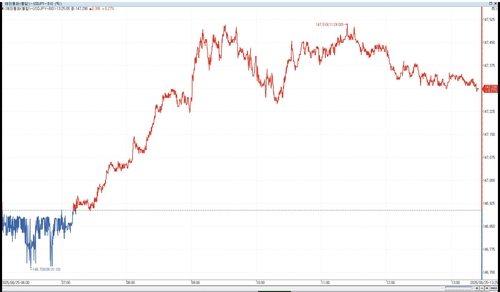

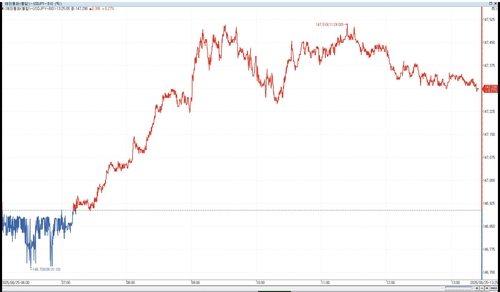

The USD/KRW exchange rate climbed to the mid-1,390 won range as foreign investors sold South Korean stocks and risk appetite weakened, with the KOSPI falling 1.14% and the dollar index declining.

#YonhapInfomax #USDKRW #KOSPI #ForeignInvestors #RiskAppetite #DollarIndex #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=79636

[Seoul Foreign Exchange Market]Risk Appetite Weakens, Foreign Investors Sell Stocks—USD/KRW Maintains Upward Momentum, Up 1.90 Won

The USD/KRW exchange rate climbed to the mid-1,390 won range as foreign investors sold South Korean stocks and risk appetite weakened, with the KOSPI falling 1.14% and the dollar index declining.

The dollar-yen exchange rate rebounded in Tokyo, rising 0.27% to 147.298 as markets partially priced in Fed rate cut expectations following Powell's Jackson Hole remarks, with risk appetite limiting yen demand.

#YonhapInfomax #DollarYen #FederalReserve #ExchangeRate #RateCutExpectations #RiskAppetite #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=78503

[Tokyo Foreign Exchange Market]Dollar-Yen Rises as Rate Cut Expectations Partially Priced In

The dollar-yen exchange rate rebounded in Tokyo, rising 0.27% to 147.298 as markets partially priced in Fed rate cut expectations following Powell's Jackson Hole remarks, with risk appetite limiting yen demand.

Japanese Yen steadies in range as BoJ-Fed divergence counters optimism

The Japanese Yen remains confined in a nearly three-week-old range against the USD.The divergent BoJ-Fed policy expectations lend some support to the lower-yielding JPY.Hopes for a Russia-Ukraine peace deal could undermine and cap th…

#Japan #JP #JapanNews #boj #fed #Japanese #Japanesenews #news #RiskAppetite #SEO #usdjpy

https://www.alojapan.com/1349519/japanese-yen-steadies-in-range-as-boj-fed-divergence-counters-optimism/

https://www.alojapan.com/1349519/japanese-yen-steadies-in-range-as-boj-fed-divergence-counters-optimism/ Japanese Yen steadies in range as BoJ-Fed divergence counters optimism

#boj #fed #Japan #JapanNews #Japanese #JapaneseNews #news #RiskAppetite #SEO #usdjpy The Japanese Yen remains confined in a nearly three-week-old range against the USD.The divergent BoJ-Fed policy expectations lend some support to the lower-yielding JPY.Hopes for a Russia-Ukraine peace deal could undermine and cap the safe-haven JPY. The Japanese Yen (JPY) is seen oscillat

Asian stock markets broadly advanced on August 18, with Japan, China, and Taiwan posting gains amid revived risk appetite, while Hong Kong edged lower; Japan's Nikkei and TOPIX set fresh record highs, and China's rally was fueled by easing trade tensions and capital inflows.

#YonhapInfomax #AsianMarkets #Nikkei225 #ShanghaiComposite #RiskAppetite #RecordHighs #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=77523

[Asian Stock Markets Summary]Broad Gains Across Asian Markets Reflect Risk Appetite

Asian stock markets broadly advanced on August 18, with Japan, China, and Taiwan posting gains amid revived risk appetite, while Hong Kong edged lower; Japan's Nikkei and TOPIX set fresh record highs, and China's rally was fueled by easing trade tensions and capital inflows.

South Korea’s dollar-won exchange rate is expected to remain in the 1,380 won range as markets await the US CPI release and monitor Russia-Ukraine ceasefire talks, with risk appetite supported by diplomatic developments and traders citing limited volatility ahead of key data.

#YonhapInfomax #DollarWon #USCPI #RiskAppetite #ExchangeRate #CeasefireTalks #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=76457

[Today's Forex Dealer Expected Exchange Rate Range]Dollar-Won Expected to Trade in 1,380 Range as Markets Eye US CPI, Russia-Ukraine Ceasefire Talks

South Korea’s dollar-won exchange rate is expected to remain in the 1,380 won range as markets await the US CPI release and monitor Russia-Ukraine ceasefire talks, with risk appetite supported by diplomatic developments and traders citing limited volatility ahead of key data.

Japanese Yen bulls seem reluctant amid BoJ uncertainty

The Japanese Yen lacks a firm intraday direction amid the holiday-thinned liquidity on Monday.The uncertainty over the timing of the next BoJ rate hike keeps the JPY bulls on the defensive. Rising Fed rate cut bets undermine the USD and act as a headwind for the US…

#Japan #JP #JapanNews #boj #fed #Japanese #Japanesenews #news #RiskAppetite #SEO #usdjpy

https://www.alojapan.com/1343738/japanese-yen-bulls-seem-reluctant-amid-boj-uncertainty/