"“The IMF’s maximum credit to Argentina… is projected to reach 1,352% of the country’s quota in 2026. This would be the Fund’s largest exposure in absolute terms in its history.”

Before we get to the meat of this story, let’s begin with a wee refresher. On April 11, as readers may recall, Argentina’s faux libertarian President Javier Milei gave a televised address to the nation. Flanked by his senior cabinet members, Milei told the Argentine people that his government had finally lifted the currency controls that had plagued the economy since 2011 so that people can once again buy dollars unhindered.

Economic stability, he said, had finally returned to the country — all thanks to another, ahem, IMF bailout, Argentina’s 23rd since becoming a member of the fund in 1956.

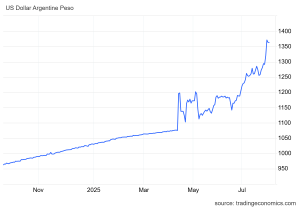

The latest $42 billion injection — $20 billion from the IMF, $12 billion from the World Bank and $10 billion from the Interamerican Development Bank — was intended to artificially prop up the peso in the months leading up to mid-term elections in October. But the peso is already in freefall, and the elections are just two months away."

#Argentina #Milei #IMF #Neoliberalism #Austerity #Debt #PublicDebt

Less Than Four Months After Joint IMF-World Bank Bailout and Lifting of Currency Controls, Argentina Is Back in Crisis Mode | naked capitalism

"The IMF's maximum credit to Argentina... is projected to reach 1,352% of the country’s quota in 2026. This would be the Fund’s largest exposure in absolute terms in its history."