How Much Did a Shirt Really Cost in the Middle Ages?

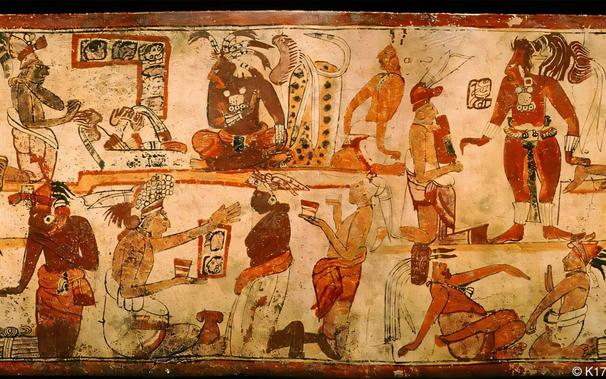

Peter Brueghel the Elder, The Harvesters (1565: now in the Metropolitan Museum of Art, New York, accession number 19.164). Photo courtesy of Wikimedia Commons.Some people on the Internet are curious about how much a shirt cost in the middle ages. Now you could try to answer that question by trying to calculate how long it would take to spin and weave the linen and sew the shirt, combining your guesses in an elaborate chain of assumptions using your modern education. A certain Eve Fisher imagined and calculated and came up with the figures $3500 or $4200 for a shirt like those depicted by painters like Peter Brueghel the Elder. This has been re-posted by a number of popular websites, and several weavers and spinners have dropped by her website to comment that they are not so sure about some of her assumptions. But did you know that we can skip all of these guesses and calculations, and the questions which they pose about whether we spin and weave as fast as people in the past, and just ask medieval people how much they paid for a shirt?

People in the 15th and 16th century have left us whole rooms full of accounts where they listed how much they had spent on particular items. Eve Fisher used a 16th century Dutch painting as her example of a typical medieval shirt, so lets look at some accounts from Tudor England. At the court of Henry VIII, a shirt consumed 2 or 3 ells (225 or 338 cm) of linen, probably somewhere between 60 and 100 cm wide, and usually worth something between 6d (six pence) and 12d the ell. Making up a shirt cost 2d unless it was embroidered. Shirts for low-ranking servants cost amounts like 14d, 19d, and 20d (pence). (Caroline Johnson, The King’s Servants, pp. 12, 20, 21-23).

What is that like in modern money? Well, most families in late medieval England had incomes between 2 and 5 pounds English a year (much lower than that, and the man was unlikely to be able to afford a spouse and feed children well enough that they lived; much higher, and they had to be living off the work of others). Christopher Dyer reckons that people in late medieval England usually worked about 240 days a year after allowing for holidays, festivals, illness, and times when they showed up at the shop and the master was not hiring journeymen that day, so an income in pounds a year is more or less pence (1/240 of a pound £) a day (240 workdays in a year). So the shirts of humble servants at Henry VIII’s court cost between 3 and 10 days’ income. That would be similar to someone who earns 10 dollars or Euros an hour spending 240 to 800 dollars or Euros on an item today. (Of course, in the 15th and 16th century, people spent much more of their incomes on food, fuel, and clothing than they do in Europe or European settler societies today, and much less on rent, transportation, and medical care … but it seems that most people could make or obtain one or two new shirts every year or so).

I think it is great that Eve Fisher tried to help people imagine what life was like before the 20th century when almost anything made by human hands was expensive. Before the 20th century, many people could only afford one new outfit a year, and the poor sometimes had to go without underwear or pawn their winter clothing in summer. It was very easy to spend a month’s income on a single garment. And Fermi problems are good geeky fun. But I think it would be better to skip the fanciful calculations and move straight to how much things actually cost and asking why that was so. Finding sources for the prices of everyday things is not easy, but I hope that this post helps people move straight to the sources rather than having to guess how long it would have taken to make a shirt.

Keep this site from going naked into the world with a monthly donation on Patreon or paypal.me or even liberapay

Further Reading:

- Christopher Dyer, Standards of Living in the Later Middle Ages (Cambridge University Press: Cambridge, 1989) {on pp. 175, 215, Anicia atte Hegge transferred her farm to her daughter-in-law in exchange for lifetime maintenance including a shirt worth 8d. every year in a decade when a thatcher’s mate earned 1 1/4d. per day, so the shirt was worth 6.4 days’ work for a beginning worker}

- Tracy P. Hudson, “Variables and Assumptions in Modern Interpretation of Ancient Spinning Technique and Technology Through Archaeological Experimentation,” ExArc https://exarc.net/ark:/88735/10147

- Caroline Johnson, The King’s Servants: Men’s Dress at the Accession of Henry VIII (Fat Goose Press, 2009) {available on Etsy}

- Sean Manning, “Historical Prices for Gamers and Writers” {many examples of garments costing a month’s income or more}

A good example of the clothing of poor people any time from the Bronze Age to the 19th century is Cato the Elder, de Agri Cultura, chapter 59: farm slaves should be given a tunic and a cloak (sagum) in alternate years, and the old tunics or cloaks should be cut up and made into patchwork. According to Geoffrey Kron, many farmhands in 19th century Naples were poorer than the slaves of thrifty Cato. The authors of the English sumptuary law of 1363, which was so strict that no court in England tried to enforce it, allowed men earning £3 to 5 a year to spend a third of that (2 marks, 4/3 pounds) on the cloth for one outfit.

Edit 2020-07-22: Changed one phrase in the first paragraph which sounded a bit harsh.

Edit 2020-09-14: Trackback from Ecofrugals. Their beautiful watercolour avatar is causing problems with my CMS so I will link this way instead.

Edit 2021-04-16: Added data and page reference in Christopher Dyer’s book

Edit 2025-04-02: block editor

#economicHistory #HenryVIII #historicalClothing #medieval #modern #tunicCosts