#YonhapInfomax

#SecuritiesBonds #MiraeAssetSecurities #CreditSpread #InvestorSentiment #CorporateBonds

#Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=104272

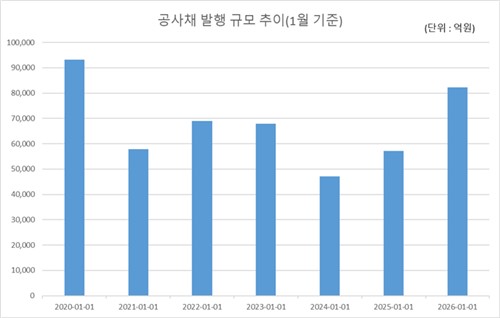

As Captive Effect Fades, Oversupply Emerges—Investor Sentiment Gauged Through Securities Bonds

South Korea's securities bond market faces widening spreads and oversupply as the captive effect wanes, with Mirae Asset Securities' latest issuance highlighting weakening investor sentiment amid rising government bond yields, while lower-rated corporate bonds retain investment appeal.