Upgrade rentals smartly! London landlords, check website in bio now! 🏢🔧

🔗 Discover more - https://millyfreeman.co.uk/updates-landlords-make-to-sell-properties/

#landlordtips #rentalupgrades #londonproperty #uklandlords #propertyinvest

Upgrade rentals smartly! London landlords, check website in bio now! 🏢🔧

🔗 Discover more - https://millyfreeman.co.uk/updates-landlords-make-to-sell-properties/

#landlordtips #rentalupgrades #londonproperty #uklandlords #propertyinvest

London landlords, stay compliant in 2025 with these key tips! 🏙️🏡

🔗 Discover more - https://boilerheatingservices.co.uk/london-landlord-compliance-2025/

#londonlandlords #propertymanagement #compliance2025 #uklandlords #landlordtips #realestateuk #tenantrights

💷 Reduce Your UK Rental Tax Bill: What Can You Deduct?

✅ Mortgage Interest – Only the 20% tax credit applies!

✅ Repairs & Maintenance – Keep your property in top shape and claim the costs.

✅ Letting Agent Fees – Fully deductible!

✅ Service Charges & Ground Rent

✅ Legal & Accountant Fees

✅ Insurance Premiums – Landlord insurance counts as an expense.

#UKLandlords #RentalIncome #PropertyTax #BuyToLet #WealthPlanning

📖 Free UK Property Tax eBook: https://zurl.co/8FeYf

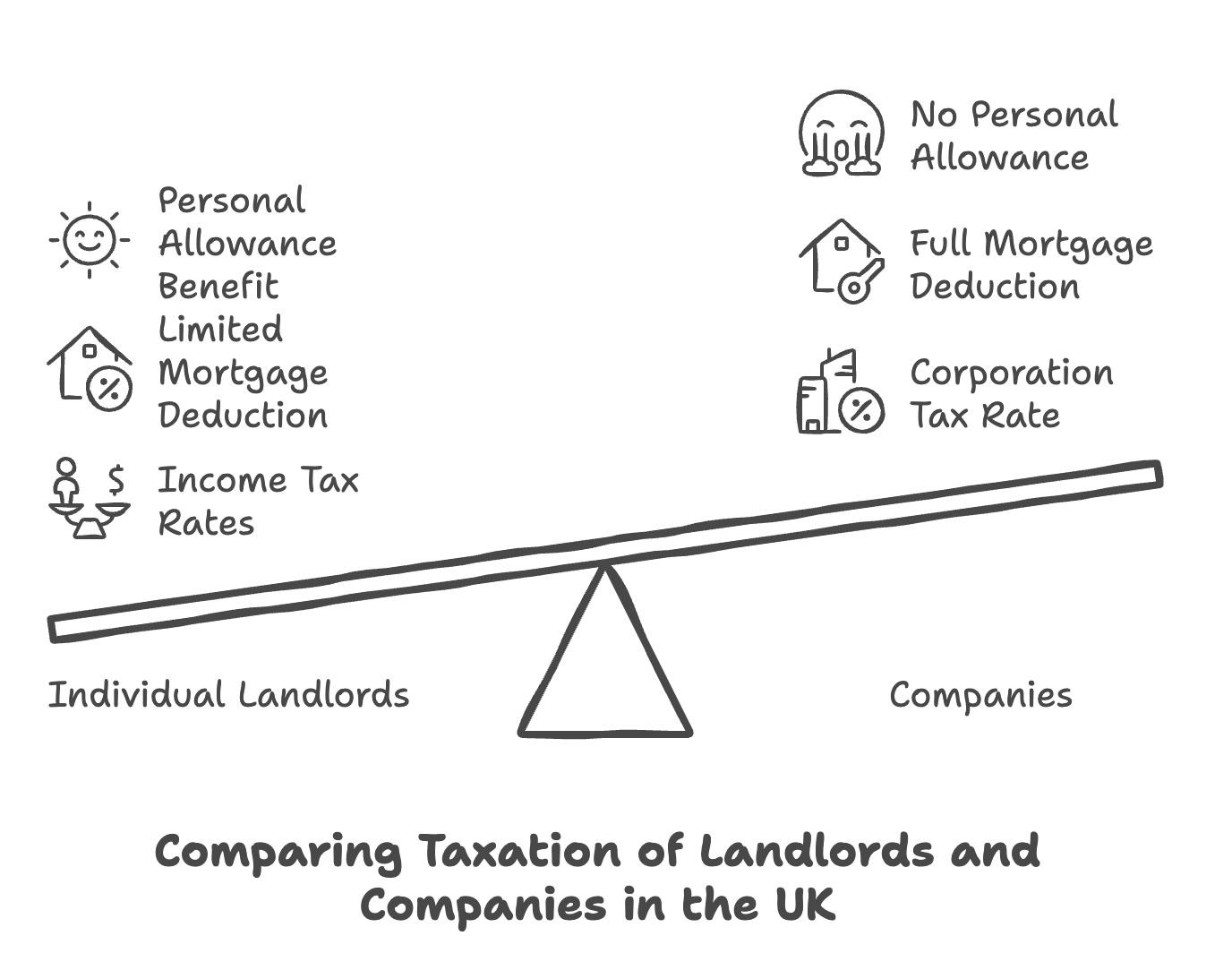

🏡 How is Rental Income Taxed for Individual Landlords vs Companies? 📊

✅ Individual Landlords: Taxed at 20-45% (income tax rates), mortgage interest relief restricted.

✅ Limited Companies: Taxed at 19-25% (corporation tax), full mortgage interest deductible.

✅ Best Option? Depends on income, growth plans & inheritance strategy.

#UKLandlords #PropertyInvestment #BuyToLet #TaxPlanning #WealthManagement

Free UK Property Tax eBook: https://zurl.co/SO9nq

Hassle-free residential property management you can trust! 🏡🛠️

🔗 Discover more—link in bio!

#propertymanagement #uklandlords #residentialhomes #tenantcare #ppmproperty

💡 What is the Let Property Campaign? HMRC’s Offer to Landlords! 🏡💰

Do you own a rental property in the UK? If you haven’t declared all your rental income, HMRC’s Let Property Campaign lets you come clean with reduced penalties.

✅ Declare unpaid tax

✅ Reduce fines & interest

✅ Avoid HMRC investigations

Act now before HMRC finds you first!

#UKLandlords #BuyToLet #HMRC #PropertyTax #LetPropertyCampaign

📖 Free UK Property Tax eBook: https://zurl.co/3IDDq

How Are Property Investment Company Profits Taxed? 🏡💰

Withdrawing profits from a property investment company?

✅ Dividends – Taxed at 8.75%-39.35% depending on your income.

✅ Salary & Bonuses – Subject to Income Tax & NICs.

✅ Director’s Loan – Risk of Section 455 tax at 33.75% if unpaid.

Strategic tax planning can save thousands! 💡

#PropertyInvesting #TaxPlanning #UKLandlords #WealthManagement #PassiveIncome

Free UK Property Tax eBook: https://zurl.co/RnjmO

💷 Reduce Your UK Rental Tax Bill: What Can You Deduct?

✅ Mortgage Interest – Only the 20% tax credit applies!

✅ Repairs & Maintenance – Keep your property in top shape and claim the costs.

✅ Letting Agent Fees – Fully deductible!

✅ Service Charges & Ground Rent

✅ Legal & Accountant Fees

✅ Insurance Premiums – Landlord insurance counts as an expense.

#UKLandlords #RentalIncome #PropertyTax #BuyToLet #WealthPlanning

📖 Free UK Property Tax eBook: https://zurl.co/8FeYf

🏡 How is Rental Income Taxed for Individual Landlords vs Companies? 📊

✅ Individual Landlords: Taxed at 20-45% (income tax rates), mortgage interest relief restricted.

✅ Limited Companies: Taxed at 19-25% (corporation tax), full mortgage interest deductible.

✅ Best Option? Depends on income, growth plans & inheritance strategy.

#UKLandlords #PropertyInvestment #BuyToLet #TaxPlanning #WealthManagement

Free UK Property Tax eBook: https://zurl.co/SO9nq