‘Extreme’ US-China decoupling could cost US$2.5 trillion, Goldman warns

US investors could be forced to sell nearly US$800 billion of Chinese stocks trading on American exchanges in case of a decoupling, the US investment bank’s analysts led by Kinger Lau and Timothy Moe said in a report on Monday. On the flip side, China could liquidate its US Treasury and equity holdings amounting to US$1.3 trillionhttps://www.scmp.com/business/china-business/article/3306443/us-china-decoupling-could-cost-us25-trillion-extreme-goldman-warns?utm_source=semaforPosted by Bingo_Swaggins

For months, dismissing Powell has been a real possibility …

https://www.reuters.com/world/us/trump-has-discussed-firing-feds-powell-with-warsh-eyed-possibe-successor-wsj-2025-04-17/ https://www.wsj.com/economy/central-banking/trump-has-for-months-privately-discussed-firing-fed-chair-powell-628d3d79 So it is clear now the talk about firing Powell hasn't been a one off thing. It has been a serious possibility that very likely could happen. He has discussed it with Bessent and Warsh and many other White House officials who all have warned him of the severe economic destabilization of doing so. As of now, we are likely at a 50/50 crossroads of whether or not he actually decides to follow through because it has been clear with this administration that no one can stop him if he decides to do it. I'm looking at the

Most U.S. stocks climbed Thursday, but the worst drop for UnitedHealth Group in a quarter of a century on the Dow Jones kept Wall Street in check.

#stock #market #business #finance #Economy #Money

https://globalnews.ca/news/11138081/wall-street-stock-market-unitedhealth/

Most U.S. stocks climbed Thursday, but the worst drop for UnitedHealth Group in a quarter of a century on the Dow Jones kept Wall Street in check.

#stock #market #business #finance #Economy #Money

https://globalnews.ca/news/11138081/wall-street-stock-market-unitedhealth/

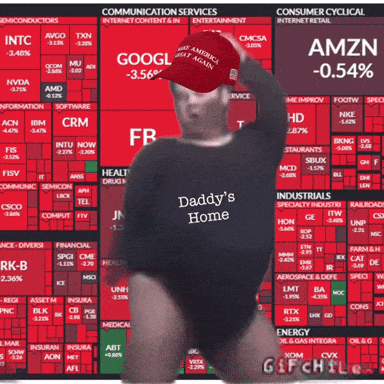

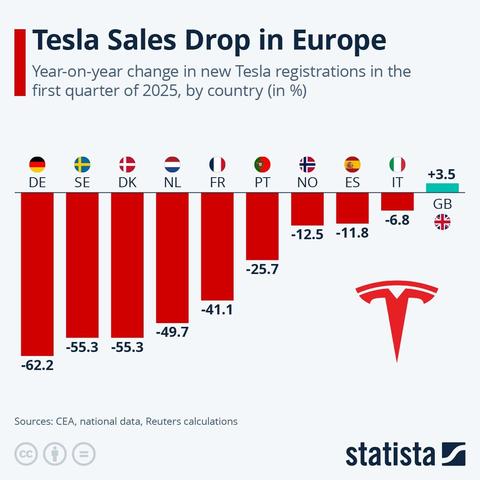

European Tesla Sales Dropping Like A Stone

Tesla’s sales fell in several European markets in March, according to data published by Reuters. The news agency reports that the new figures add signs that drivers are turning away from Elon Musk’s electric car brand as competition from Chinese car manufacturers increases and some protest his political views. Tesla’s quarterly sales fell by around 62 percent in Germany, 55 percent in Sweden and Denmark, almost 50 percent in the Netherlands and 41 percent in France. The United Kingdom continues to be Tesla's biggest market in Europe and was the only country in the continent to see a sales increase

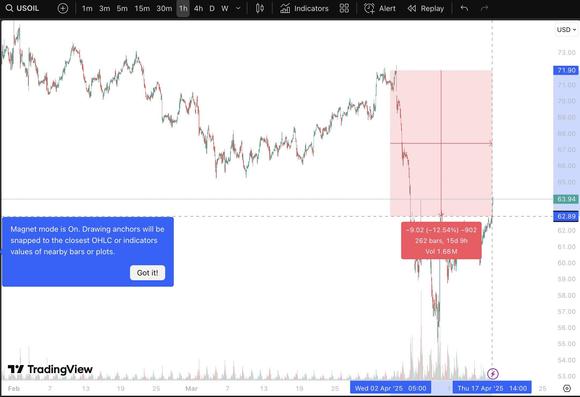

Oil now trading at almost 60$ per barrel

With the recent trump administration the price of oil has kept decreasing.In the geopolitical context this will make Russia suffer a lot with an ongoing war and the idea to not be able to profit from oil as much as they used to anymore. The devaluation of oil is also due to an increase in supply from south Arabia which is targeting once again Russia. What do you think oil will be back on track at levels of 80$ per barrel? https://i.redd.it/bonra03f9fve1.jpegPosted by Lucky_Ad1144

Do NOT miss this Region For Bitcoin! Cryptocurrency Market Update in Urdu and Hindi

Do NOT miss this Region For Bitcoin! Cryptocurrency Market Update in Urdu and Hindi🌟 Exclusive Toobit Surprise 😮 https://www.toobit.com/t/S5a6a9💥 Special CoinCatch Rewards 👉 https://partner.coincatch.cc/bg/YC5JM8🔥 Unique Bybit Gifts 👉 https://partner.bybit.com/b/s5a6a9~~~~~~~~~~~~~~~~~~~~~~~~~~~📜 Disclaimer 📜 The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.

United Healthcare currently down ~23% today after missing earnings and slashing future forecasts, total loss of ~$100b in market cap

United Healthcare has 400k employees and is the 4th largest revenue earner among F500 companies after Walmart, Apple, and Amazon. (https://en.wikipedia.org/wiki/Fortune_500) I don't think there has ever been this large of a drop in any of the top 10 companies in the F500 in a single trading day? From what I found on Google - the largest was Apple's ~10% drops, and Meta's ~15% drop. Crazy this is happening to the largest healthcare stock. Comments 'Peer stocks were collateral damage on Thursday. CVS Health, Elevance Health, and Humana fell 6%, 6.2%, and 6.9%, respectively.' 'The change was partially driven by “heightened care activity indications