#GSTR3B #GSTReturn #TaxCompliance #FinanceReminder #GSTIndia #DueDateUpdate

📆 GSTR-3B for April 2025 is due by 20th May 2025 for those with turnover above ₹5 crore in the last FY or not opted for QRMP. Ensure timely filing for the Apr–Jun quarter.

#GSTR3B #GSTReturn #TaxCompliance #FinanceReminder #GSTIndia #DueDateUpdate

#GSTR3B #GSTReturn #TaxCompliance #FinanceReminder #GSTIndia #DueDateUpdate

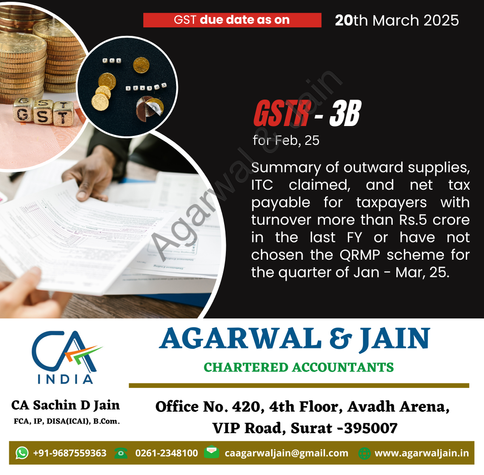

📢 Reminder: The due date for GSTR-3B for Feb 2025 is 20th March 2025. Ensure timely filing to report outward supplies, ITC claimed & net tax payable. Applies to taxpayers with turnover > ₹5 Cr or those not in QRMP for Jan-Mar 2025. ✅ #GST #Compliance #GSTR3B #TaxFiling

📅 GST Compliance Alert

🔹 GSTR-3B for January 2025

📌 Due on 20th February 2025

📌 Applicable for taxpayers with turnover > ₹5 crore in the last FY or those not under QRMP for Jan-Mar 2025.

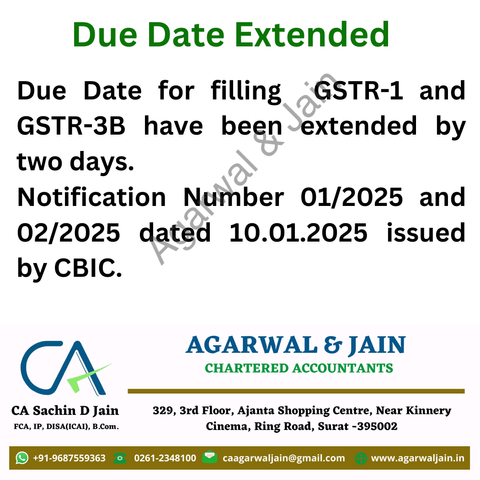

📢 Due Date Extended 📢

The due date for filing GSTR-1 & GSTR-3B has been extended by two days as per CBIC Notification No. 01/2025 & 02/2025 dated 10.01.2025. Stay updated & ensure timely compliance! 📝📊 #GSTUpdate #GSTR1 #GSTR3B #TaxCompliance #Finance #CBIC #BusinessUpdates

Reminder: GSTR-3B for Nov 2024 is due on 20th Dec 2024. Applicable to taxpayers with turnover > ₹5 Cr or not under QRMP for Oct-Dec 2024. File timely to ensure compliance. #GST #GSTR3B #TaxUpdates #GSTCompliance #OutwardSupplies #ITC #DueDateAlert #StayCompliant

🚨 GST Alert: GSTR-3B due on 20th Dec 2024 for Nov. Includes outward supplies, ITC claimed, and net tax payable. Applicable to taxpayers with turnover > ₹5 crore in FY or not under QRMP scheme for Oct-Dec 2024. Stay updated! #GST #TaxCompliance #GSTR3B #GSTReturns

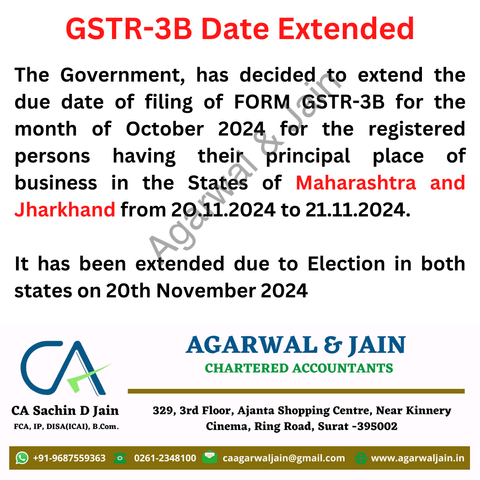

📢 Important GST Update: Due date for filing GSTR-3B for October 2024 has been extended for Maharashtra & Jharkhand businesses from 20th Nov 2024 to 21st Nov 2024 due to state elections. #GSTR3B #GSTCompliance #TaxUpdate #Maharashtra #Jharkhand #GST

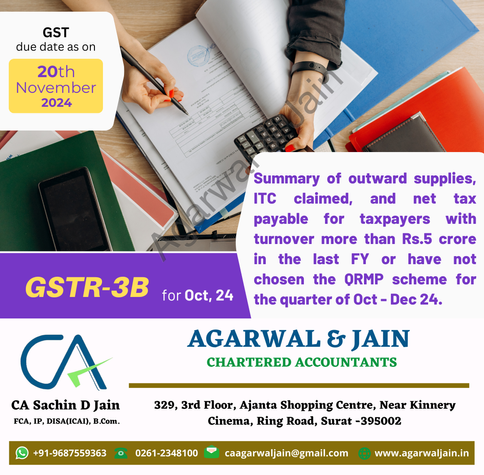

📅 Mark your calendars! The due date for GSTR-3B for October 2024 is November 20th. Ensure timely filing for taxpayers with a turnover above ₹5 crore or those outside the QRMP scheme for Oct-Dec 2024. #GSTR3B #GST #TaxCompliance #Finance #Accounting #AgarwalAndJain

Hard-locking of tax liabilities in GSTR-3B starts January 2025. Auto-locking of Input Tax Credit (ITC) is deferred until the full rollout of the Invoice Management System (IMS). Further advisory will follow. #GSTUpdate #GSTR3B #TaxCompliance #ITC #Finance

What is GSTR-3B? Eligibility, Documents Required, Due Dates & Penalties. File GSTR-1 timely with our assistance!

Learn More :

https://www.setindiabiz.com/learning/gstr-3b-gst-return