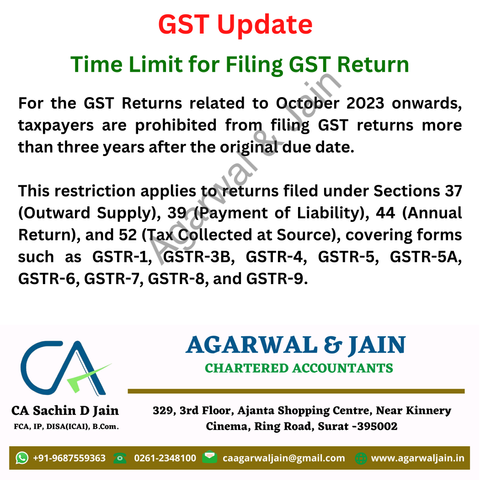

📢 GST Update: From October 2023, filing GST returns beyond three years from the original due date is prohibited. This applies to forms like GSTR-1, GSTR-3B, GSTR-9, and others. Stay updated and compliant. #GST #Compliance #TaxUpdate #GSTR #Finance #AgarwalAndJain

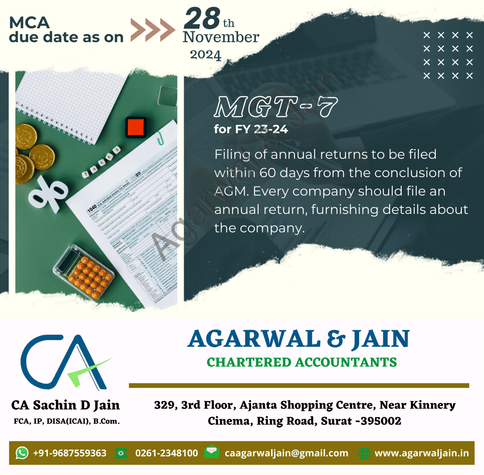

📅 Important reminder: MGT-7 annual return for FY 23-24 is due by November 28, 2024. This filing, required within 60 days of the AGM, provides essential details about the company. Ensure timely submission. #MGT7 #CompanyCompliance #AnnualReturn #MCA #AgarwalAndJain

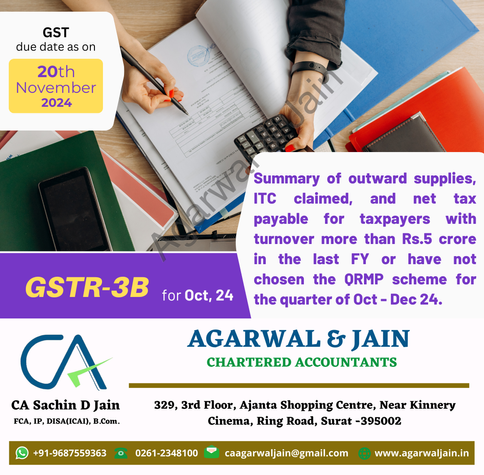

📅 Mark your calendars! The due date for GSTR-3B for October 2024 is November 20th. Ensure timely filing for taxpayers with a turnover above ₹5 crore or those outside the QRMP scheme for Oct-Dec 2024. #GSTR3B #GST #TaxCompliance #Finance #Accounting #AgarwalAndJain

📅 Reminder: The due date for PF & ESIC payments for October 2024 is November 15, 2024. Ensure timely compliance for PF deducted from employees' October salaries and monthly ESIC contributions. #PF #ESIC #Compliance #Payroll #Accounting #Finance #AgarwalAndJain