Are ISAs Taxable in the USA? 🇬🇧➡️🇺🇸

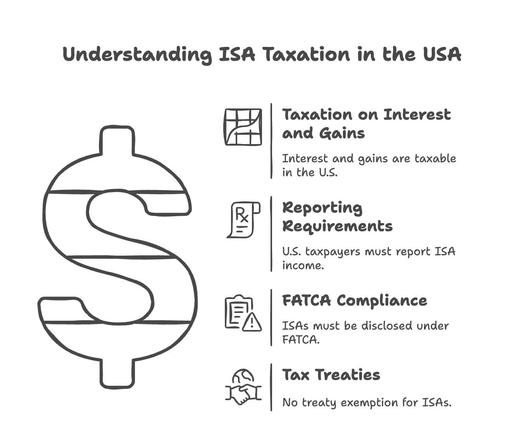

If you're a UK expat in the U.S., your Individual Savings Account (ISA) isn’t tax-free! 🚨 The IRS does not recognise ISAs as tax-exempt, meaning:

✅ Interest & dividends are taxable in the U.S.

✅ Capital gains may also be taxed.

✅ Reporting is required on FBAR & FATCA.

📌 Plan wisely to avoid penalties!

#USExpats #ISATax #UKtoUSA #DoubleTaxation #ExpatFinance

📚 Free Expat Tax Planning eBook: https://zurl.co/WHbVZ