CD Rates Near 3%—TIGER CD 1-Year Active ETF Draws 500 Billion Won Inflows This Month

South Korea's TIGER CD 1-Year Active ETF saw 500 billion won ($384 million) in inflows this month as short-term rates neared 3%, reflecting surging demand for high-yield parking-type products.

Lee Chang-yong Says 'CD Rate No Longer Suitable as Short-Term Interest Rate Benchmark'

Bank of Korea Governor Lee Chang-yong signals a shift in South Korea's short-term rate benchmarks, questioning the continued use of the CD rate.

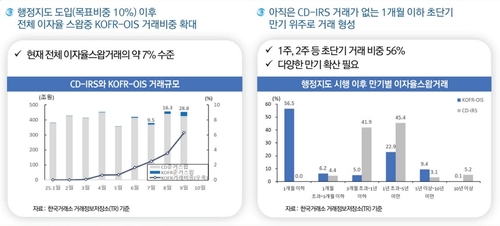

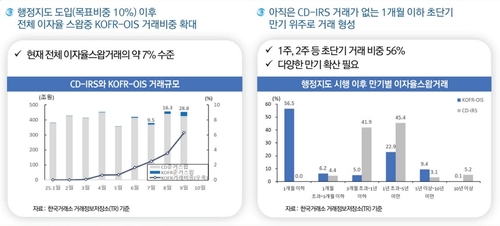

The Bank of Korea reported a 70-fold surge in KOFR-OIS trading, now accounting for 7% of all swaps, and stressed the urgent need to discontinue CD rate publication to accelerate the transition to KOFR as South Korea’s key reference rate.

#YonhapInfomax #BankOfKorea #KOFR #OIS #CDRate #InterestRateSwap #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=89152

Bank of Korea Says KOFR-OIS Trading Surges 70-Fold—Urgency Grows for CD Rate Discontinuation

The Bank of Korea reported a 70-fold surge in KOFR-OIS trading, now accounting for 7% of all swaps, and stressed the urgent need to discontinue CD rate publication to accelerate the transition to KOFR as South Korea’s key reference rate.

South Korean insurers’ adoption of KOFR-based interest rate swaps to hedge fixed-rate insurance liabilities is expected to accelerate KOFR market development, as current IRS transactions remain dominated by CD rates despite regulatory efforts to promote KOFR as the risk-free benchmark.

#YonhapInfomax #KOFR #InterestRateSwap #InsuranceLiabilities #CDRate #RiskFreeRate #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=83367

[Insurance Companies Derivatives ALM③] 'KOFR Market Activation'—The Ripple Effect of IRS Hedging

South Korean insurers’ adoption of KOFR-based interest rate swaps to hedge fixed-rate insurance liabilities is expected to accelerate KOFR market development, as current IRS transactions remain dominated by CD rates despite regulatory efforts to promote KOFR as the risk-free benchmark.

Korea Investment Management Co. will rename its parking-type ETF to "ACE Money Market Active," aligning with rising demand for short-term cash management and the growing dominance of money market funds in South Korea's ETF market.

#YonhapInfomax #KoreaInvestmentManagement #MoneyMarketFund #ETF #ShortTermBonds #CDRate #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=64614

'Parking-Type Funds - MMFs Take the Lead'—Korea Investment Management Renames ETF to ACE Money Market Active - Yonhap Infomax

Korea Investment Management Co. will rename its parking-type ETF to "ACE Money Market Acti

Lãi suất Tiết kiệm Cao Ngất Ngưởng Bắt Đầu Giảm? Cập Nhật Tình Hình Ngày 30/11/2023

## Lãi suất Tiết kiệm Cao Ngất Ngưởng Bắt Đầu Giảm? Cập Nhật Tình Hình Ngày 30/11/2023 #laisuat #tietkiem #cdrate #dauco #taichinh #queenmobile #muangay Bài viết gốc từ CNET ngày 30/11/2023 cho thấy xu hướng giảm nhẹ trong lãi suất kỳ hạn (CD Rates) sau giai đoạn tăng cao kỷ lục. Tin tức này đáng chú ý đối với những người đang tìm kiếm các lựa chọn tiết kiệm sinh lời.

https://dienmay.pro.vn/lai-suat-tiet-kiem-cao-ngat-nguong-bat-dau-giam-cap-nhat-tinh-hinh-ngay-30-11-2023

Lãi suất Tiết kiệm Cao Ngất Ngưởng Bắt Đầu Giảm? Cập Nhật Tình Hình Ngày 30/11/2023 | Phụ Kiện Đỉnh

## Lãi suất Tiết kiệm Cao Ngất Ngưởng Bắt Đầu Giảm? Cập Nhật Tình Hình Ngày 30/11/2023 #laisuat #tietkiem #cdrate #dauco #taichinh #queenmobile #muangay Bài viết gốc từ CNET ngày 30/11/2023 cho thấy xu hướng giảm nhẹ trong lãi suất kỳ hạn (CD Rates) sau giai đoạn tăng cao kỷ lục. Tin tức này đáng [...]

CD Rate Falls Below Base Rate - Is Market Pricing in May Rate Cut?

South Korean 91-day CD rate falls below base rate, sparking speculation of potential May rate cut by Bank of Korea amid economic uncertainties and market expectations

CD 91-Day Rate Falls Below Base Rate for First Time Since February 25

91-day CD rate drops below Bank of Korea's base rate for the first time since February 25, signaling potential shift in short-term interest rate dynamics

Short-term bonds in South Korea's market remain weak due to uncertainty over additional rate cuts and high funding costs, with CD rates showing little change despite recent base rate reduction.

#YonhapInfomax #ShortTermBonds #BaseRate #CDRate #MoneyMarket #BondWeakness #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=53414

Short-term Bonds Struggle - When Will the Weakness End?

Short-term bonds in South Korea's market remain weak due to uncertainty over additional rate cuts and high funding costs, with CD rates showing little change despite recent base rate reduction.