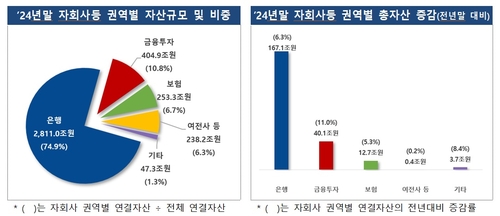

Top 10 Financial Holding Companies' Net Profit Reaches 24 Trillion Won Last Year, NPL Ratio at 0.90%

Major South Korean financial holding companies report 24 trillion won net profit for 2024, with NPL ratio rising to 0.90% amid economic uncertainties and high interest rates

Lotte Card Faces Soundness Crisis Due to Homeplus-Related 'Provisions and Delinquencies'

Lotte Card faces potential asset quality crisis due to Homeplus rehabilitation, with expected large provisions and rising delinquency rates impacting first-half performance

South Korean savings banks face credit rating downgrades as profitability and asset quality deteriorate due to prolonged high interest rates and non-performing real estate project financing loans, pushing some institutions closer to junk status.

#YonhapInfomax #SavingsBanks #CreditRatingDowngrades #RealEstatePF #AssetQuality #RetirementPensions #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=58675

Savings Banks' Credit Ratings Plummet - Junk Status Looms

South Korean savings banks face credit rating downgrades as profitability and asset quality deteriorate due to prolonged high interest rates and non-performing real estate project financing loans, pushing some institutions closer to junk status.

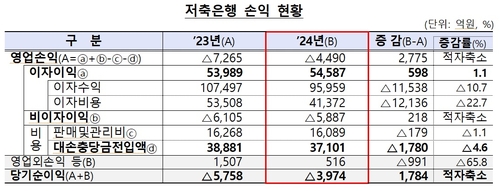

Savings Banks Record Net Loss of 397.4 Billion Won Last Year, Deficit Narrows on Reduced Interest Expenses

South Korean savings banks report 397.4 billion won net loss in 2023, showing improvement despite ongoing challenges in asset quality and economic uncertainties

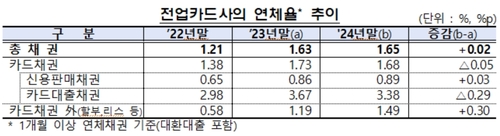

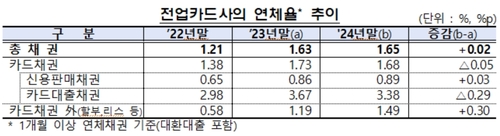

South Korean credit card delinquency rates hit a 10-year high in 2024, reflecting economic challenges and tightened lending regulations, prompting financial authorities to strengthen oversight and consider policy adjustments.

#YonhapInfomax #CreditCardDelinquency #AssetQuality #FinancialSupervisoryService #EconomicDownturn #LendingRegulations #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=54624

Credit Card Delinquency Rate Hits 10-Year High, Asset Quality Deteriorates

South Korean credit card delinquency rates hit a 10-year high in 2024, reflecting economic challenges and tightened lending regulations, prompting financial authorities to strengthen oversight and consider policy adjustments.

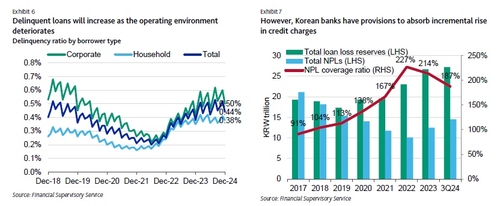

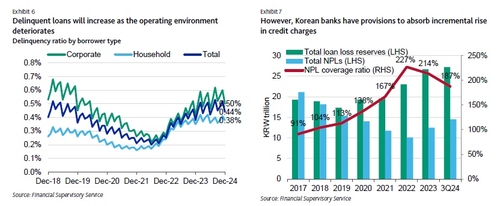

Moody's maintains negative outlook for Korean banking system, citing concerns over economic slowdown, deteriorating asset quality, and weakening profitability amid challenging operating environment.

#YonhapInfomax #MoodysOutlook #KoreanBanks #EconomicSlowdown #AssetQuality #Profitability #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=53978

Moody's - 'Korean Banks Face Concerns Over Economic Slowdown, Profitability Decline - Negative Outlook Maintained'

Moody's maintains negative outlook for Korean banking system, citing concerns over economic slowdown, deteriorating asset quality, and weakening profitability amid challenging operating environment.

Korea Ratings - Lotte Card's 80 Billion Won Factoring Debt Overdue, Impacting Asset Quality

Korea Ratings warns of potential asset quality deterioration for Lotte Card due to 78.6 billion won overdue factoring debt, highlighting increased risk in non-credit sales assets.

DGB Financial - 'Capital Ratio Improvement Takes Priority Over Growth... Cutting Ties with PF Burden'

DGB Financial Group shifts focus to capital ratio improvement over growth, aiming to overcome project financing burdens and enhance shareholder value through strategic portfolio management.

Bank Loan Loss Provisions Down 2 Trillion Won Despite Growing Economic Risks

Major South Korean banks reduce loan loss provisions by 23% to 7 trillion won in 2023 despite growing economic risks, raising concerns about preparedness for potential financial instability.

Bank Loan Loss Provisions Down 2 Trillion Won Despite Growing Economic Risks

Major South Korean banks reduce loan loss provisions by 23% to 7 trillion won in 2023 despite growing economic risks, raising concerns about preparedness for potential financial instability.