South Korea's dollar-won exchange rate trimmed earlier gains, retreating to the high 1,420s after a rare joint verbal intervention by foreign exchange authorities signaled heightened market vigilance.

#YonhapInfomax #DollarWon #ExchangeRate #FXAuthorities #VerbalIntervention #MarketVigilance #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85211

Dollar-Won Gains Narrow as FX Authorities Issue Joint Verbal Intervention, Pair Retreats to High 1,420s

South Korea's dollar-won exchange rate trimmed earlier gains, retreating to the high 1,420s after a rare joint verbal intervention by foreign exchange authorities signaled heightened market vigilance.

The People's Bank of China set the yuan's reference rate 0.06% higher at 7.1007 per dollar, marking a notable appreciation as the central bank continues to guide the currency amid global market volatility.

#YonhapInfomax #PeoplesBankOfChina #Yuan #ExchangeRate #Appreciation #ReferenceRate #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85192

Yuan Reference Rate Set 0.06% Higher at 7.1007 per Dollar

The People's Bank of China set the yuan's reference rate 0.06% higher at 7.1007 per dollar, marking a notable appreciation as the central bank continues to guide the currency amid global market volatility.

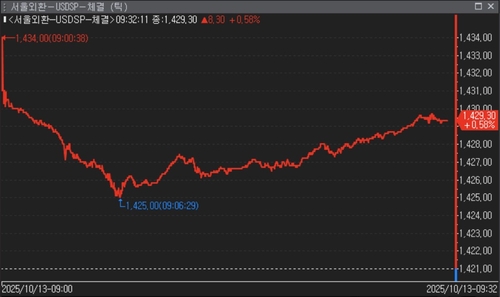

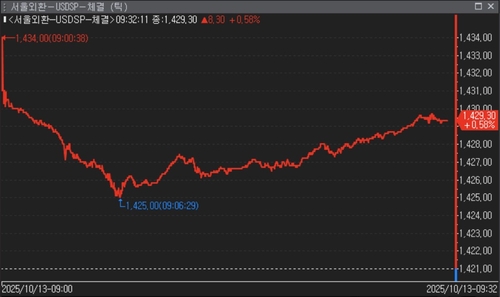

The dollar-won exchange rate briefly surpassed 1,430 for the first time in five months amid renewed US-China tariff tensions, with risk-off sentiment driving the won lower and South Korea's KOSPI index falling 1.54% as global trade uncertainty intensified.

#YonhapInfomax #DollarWon #USChinaTrade #KOSPI #ExchangeRate #TariffTensions #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85181

[Seoul Foreign Exchange Market]Dollar-Won Rate Briefly Tops 1,430 on Renewed US-China Tariff War Fears—Up 8.30 Won

The dollar-won exchange rate briefly surpassed 1,430 for the first time in five months amid renewed US-China tariff tensions, with risk-off sentiment driving the won lower and South Korea's KOSPI index falling 1.54% as global trade uncertainty intensified.

South Korea's dollar-won exchange rate briefly traded in the 1,330 won range due to a deal error at market open, with all erroneous transactions subsequently cancelled and the intraday low revised to 1,425.00 won.

#YonhapInfomax #DollarWon #ExchangeRate #DealError #SeoulForeignExchange #IntradayLow #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85175

Dollar-Won Trades in the 1,330 Range Confirmed as Deal Error—All Transactions Cancelled

South Korea's dollar-won exchange rate briefly traded in the 1,330 won range due to a deal error at market open, with all erroneous transactions subsequently cancelled and the intraday low revised to 1,425.00 won.

Dollar-Won Surges Above 1,430 in Early Trading—First Time Since May 2

The Korean won weakens sharply as the dollar-won exchange rate breaches the 1,430 mark in early trading, hitting its highest level since May 2 and signaling renewed market volatility.

South Korea’s won is expected to weaken to around 1,430 per dollar as renewed US-China trade tensions and risk-off sentiment drive the exchange rate higher, with dealers citing potential foreign outflows and Trump’s tariff threats as key factors.

#YonhapInfomax #DollarWon #USChinaTrade #ExchangeRate #ForeignInvestors #TariffThreats #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85161

[Today's Forex Dealer Expected Exchange Rate Range]Dollar-Won Rate Expected to Rise to Around 1,430 on Renewed US-China Trade Tensions

South Korea’s won is expected to weaken to around 1,430 per dollar as renewed US-China trade tensions and risk-off sentiment drive the exchange rate higher, with dealers citing potential foreign outflows and Trump’s tariff threats as key factors.

South Korea’s top financial holding firms are expected to post steady Q3 earnings on strong corporate lending, but Q4 faces uncertainty as new household loan curbs threaten growth; KB, Shinhan, Hana, and Woori project mixed profit trends amid regulatory and FX risks.

#YonhapInfomax #FinancialHoldingCompanies #NetProfit #CorporateLending #HouseholdLoanRegulations #ExchangeRate #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85136

Major Korean Financial Holding Firms Expected to Post Solid Q3 Results—Household Lending Curbs Loom as Q4 Wildcard

South Korea’s top financial holding firms are expected to post steady Q3 earnings on strong corporate lending, but Q4 faces uncertainty as new household loan curbs threaten growth; KB, Shinhan, Hana, and Woori project mixed profit trends amid regulatory and FX risks.

[From the Head of Research] Hyundai Motor Securities' Noh Geun-chang – 'Rising Exchange Rates a Boon for Semiconductors'

Hyundai Motor Securities' Noh Geun-chang says a weaker won benefits South Korea's semiconductor exporters, supporting KOSPI gains as AI demand boosts Samsung Electronics and SK hynix.

The one-month dollar-won NDF rose to 1,431.50 won in New York, up 12.60 won from Seoul’s previous close, as the US dollar weakened on Trump’s tariff threats against China and risk aversion boosted the yen.

#YonhapInfomax #NDF #DollarWon #Trump #Tariffs #ExchangeRate #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85083

NDF Rises to 1,431.30/1,431.70 Won—Up 12.60 Won

The one-month dollar-won NDF rose to 1,431.50 won in New York, up 12.60 won from Seoul’s previous close, as the US dollar weakened on Trump’s tariff threats against China and risk aversion boosted the yen.

The dollar-won exchange rate surged above 1,430 for the first time since May, as Trump’s renewed tariff threats against China rattled markets and triggered sharp declines in U.S. equities.

#YonhapInfomax #DollarWon #Trump #TariffThreat #ExchangeRate #USChinaTensions #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket https://en.infomaxai.com/news/articleView.html?idxno=85059

Dollar-Won Surges Above 1,430 on Trump’s Tariff Threat Against China

The dollar-won exchange rate surged above 1,430 for the first time since May, as Trump’s renewed tariff threats against China rattled markets and triggered sharp declines in U.S. equities.